What is the process for receiving a SRTS non-infrastructure grant?

So you’ve received an email informing you that your request for Safe Routes funding has been awarded. Congratulations! Now what?

New grant awards are contingent on submitting a signed resolution, final budget, approved scope of work and any additional paperwork requested by MnDOT within 60 days of the award notification or the grant award may be withdrawn. Keep an eye out for an email from MN_DOT_Transit, as this is the email address used to send contracts to new grantees.

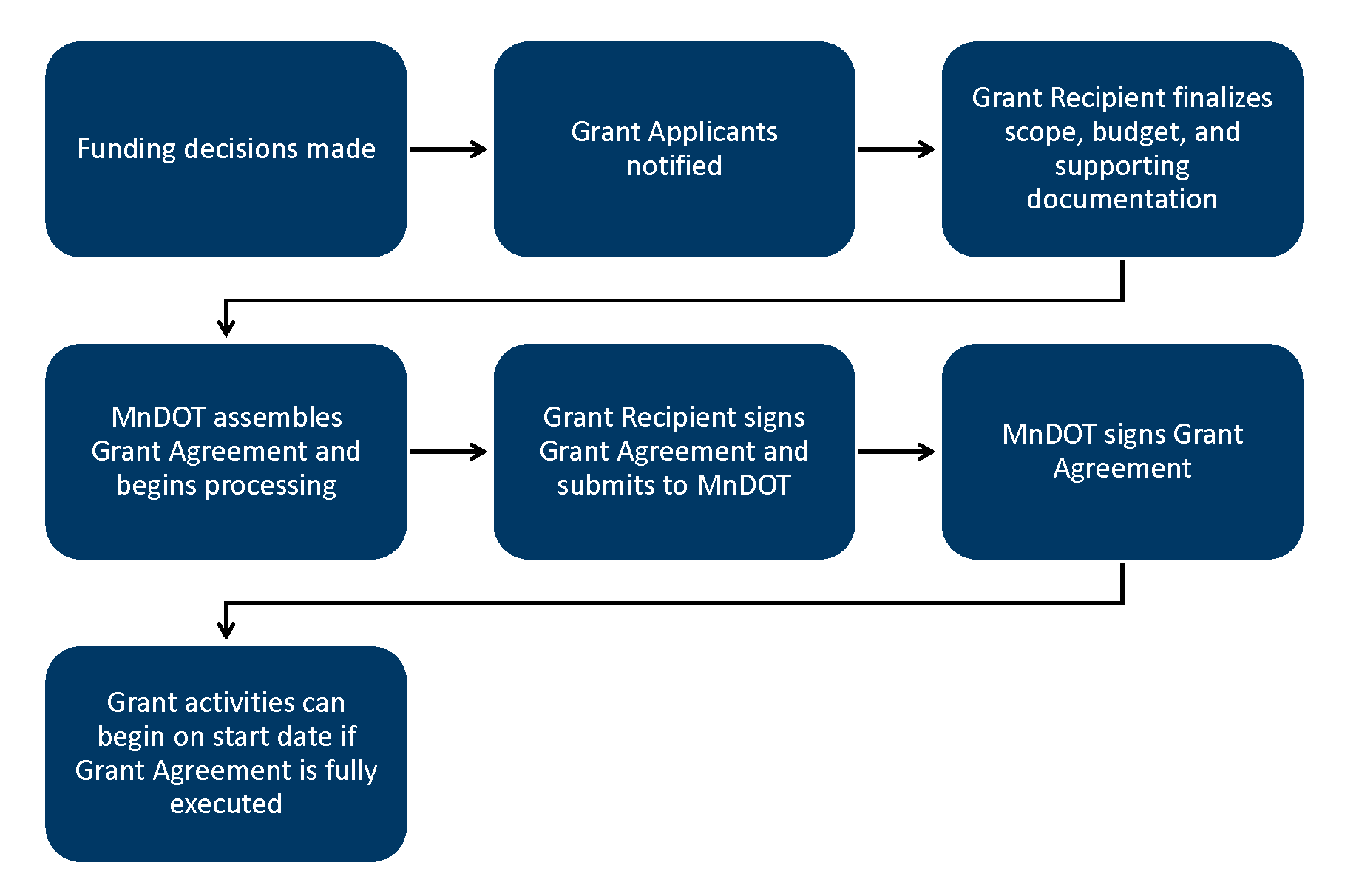

Regardless of funding source (state, federal, or other , the primary steps to process the grant agreement are generally as follows:

- Funding decisions for SRTS grants are made in consultation with an advisory committee comprised on state agency and external SRTS partners based on the selection criteria outlined in the grant application and are typically finalized within two months of the application deadline. Notifications to grantees of grant awards occur as soon as possible after funding decisions are made.

- Notification of a grant award will be in the form of an email from the SRTS staff at MnDOT. This notification includes instructions for further processing of the grant agreement and may also contain grant-specific information such as requirements for finalizing scopes of work, making any budget changes requested by review committee, and ensuring all paperwork is in order to process the grant. Read these instructions carefully as requirements can vary by grant and fiscal year.

- In general, after receiving notice of award, the grant recipient should expect to complete the following tasks before receiving an executed grant agreement:

- Confirm the authorized signatory agent for your organization including name, title, and contact information with phone, email, and address.

- Draft, pass and submit to MnDOT SRTS staff a resolution executed by your governing body to enter an agreement and any amendments with MnDOT and who is authorized to sign the grant agreement. A template may be provided with your grant award next steps notification.

- Finalize the grant budget, which may include any budget adjustments recommended by MnDOT SRTS staff and the advisory committee. After the contract is executed this budget will be used and referenced for reimbursement payments. Any expenditures not listed on this budget may required additional forms to be submitted documenting the change and approval by staff.

- Review the scope of work provided to you by the Safe Routes team and come to an agreement about its stipulations. This scope of work will be referenced to ensure expenditures meet the deliverables listed, ensure a successful project, and are allowable activities and expenses.

- Sign and submit final grant agreement to TransitContracts.dot@state.mn.us and wait for MnDOT Notice to Proceed email that indicates your grant agreement is fully executed before making any expenditures. Please note, while a contract may state a July 1 start date, the contract is not valid until all parties have signed, which may be later than July 1 and could impact eligibility for reimbursements.

- Attend or review the recorded webinar on purchasing, invoicing, and reporting for your SRTS grant.

- NOTE: Delay in completing these additional requirements will delay processing of the grant agreement and future requests for reimbursement.

- Once these materials have been completed and the grant agreement has been assembled by MnDOT and signed by the grantee, the signed grant agreement is returned to MnDOT for processing via email MN_DOT_Transit (TransitContracts.dot@state.mn.us).

- Grant agreements cannot be executed and funds will not be eligible for reimbursement by MnDOT until all grant specific requirements have been completed, including:

- The provision of an organizational chart,

- a signed resolution from the organization, and

- A confirmed project budget.

- Grant award may be rescinded if all documents are not received within 60 days.

- Grant agreements are considered executed when they have been signed by the grantee and MnDOT, and when the grant recipient has been given official notice of the start date from SRTS staff. The grantee must not begin work under the grant agreement and no grant or match costs may be incurred or funds expended until the agreement is fully executed. Please wait for MnDOT to send a Notice to Proceed email that indicates your grant agreement is fully executed before making any expenditures. Please note, while a contract may state a July 1 start date, the contract is not valid until all parties have signed which may be later than July 1 which could impact eligibility for reimbursements.

- MnDOT SRTS grants are reimbursement only, meaning that after the grant contract has been fully executed the grant recipient can begin incurring expenses. After submitting complete documentation of expenses and payment via MnDOT invoice guidance, the grant recipient will be reimbursed for these actual and eligible costs.

- Monthly reporting and final reporting on activities accomplished with grant funds is required per the grant agreement.

- All grant recipients must be prepared for monitoring and review of grant activities both throughout and after the grant period. Grant agreement documents, receipts, invoices, and progress reports must be made available upon request per the grant agreement.

Financial review of non-governmental organizations

When MnDOT selects applicants to award a grant (state or federally funded) over $25,000, a review of the financial statements of any selected non-governmental organization (nonprofit) must be completed prior to executing a grant contract.

Prior to execution of the contract, documentation may be required based on operating budget of the organization:

- Nonprofits with total annual revenue under $50,000 should submit their most recent board-reviewed financial statements.

- Nonprofits with total annual revenue between $50,000 - $750,000 should submit their most recent IRS Form 990/990-EZ.

- Nonprofits with total annual revenue over $750,000 should submit their most recent certified financial audit.